Legacy Planning for Malaysians: Wills vs Trusts

ZiggFin

May 18, 2025

Legacy Planning for Malaysians: Wills vs Trusts

For many Malaysians, legacy planning is often something we only think about later in life. But as more families face complex financial responsibilities and rising intergenerational wealth, planning ahead has become a practical need—not just a formality. Whether you're in your 30s building assets, or nearing retirement with a family to support, understanding the difference between wills and trusts can help secure your loved ones' future and reduce disputes.

In this guide, we'll explain the basics of wills and trusts in the Malaysian context, and how each tool plays a role in a complete legacy plan.

What Is Legacy Planning?

Legacy planning refers to the process of deciding how you want your assets, responsibilities, and wishes to be managed and passed on after your death. In Malaysia, this involves:

- • Distributing property and savings

- • Assigning guardianship for dependents

- • Handling business continuity

- • Minimising potential conflicts among heirs

- • Ensuring Shariah compliance (for Muslim families)

Two of the most common tools used are wills and trusts.

What Is a Will?

A will is a legal document that spells out how your assets should be distributed when you pass away. It typically includes:

- • A list of beneficiaries (who gets what)

- • An executor (someone you trust to carry out your instructions)

- • Guardianship nominations (for children under 18)

Pros of Having a Will:

- • Simple and affordable to prepare

- • Ensures your assets go to the right people

- • Can be updated as your situation changes

Limitations:

- • Must go through probate, which can take months or years

- • Can be challenged in court

- • Only takes effect after your death

In Malaysia, wills are governed under the Wills Act 1959 (for non-Muslims). For Muslims, faraid rules apply and can override some will provisions unless a trust or hibah is used appropriately.

What Is a Trust?

A trust is a legal arrangement where you transfer assets to a trustee, who holds and manages them for the benefit of your beneficiaries. It can be set up while you're alive (living trust) or upon death (testamentary trust).

Pros of Having a Trust:

- • Assets can be managed and distributed without going through probate

- • Offers more privacy and control

- • Can protect vulnerable beneficiaries (e.g. minors, special needs)

- • Useful for business succession planning

Limitations:

- • More expensive and complex to set up

- • Needs professional advice and trustee services

Trusts in Malaysia are governed by the Trustee Act 1949 and related case law. For Muslim families, hibah trusts are commonly used to distribute property outside of faraid rules.

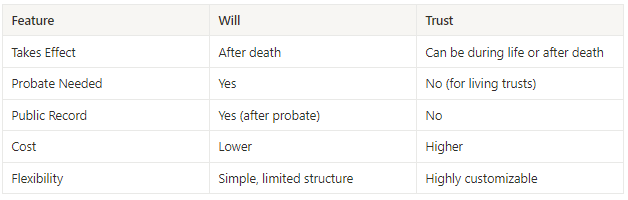

Wills vs Trusts: Key Differences

Which One Do You Need?

Most Malaysians benefit from having both. Here’s a typical approach:

- • Start with a will if you're younger, have a simpler estate, or are just beginning.

- • Add a trust if you have complex assets, family businesses, or want to provide ongoing financial support for loved ones.

A will ensures nothing is left out. A trust adds flexibility, privacy, and protection.

Case Study: A Malaysian Family's Experience

Mr. Lim, a 55-year-old SME owner in Penang, created a will to pass his house to his children and a business succession plan. However, after his sudden passing, the will took over a year to go through probate. His family faced delays accessing funds.

Later, his brother opted for a living trust structure. When he passed, his assets were smoothly transferred to his children without court involvement.

The difference? The trust avoided delays, legal costs, and stress.

Common Misconceptions About Legacy Planning

- • "I’m still young; I don’t need a will yet." → Accidents can happen anytime.

- • "My assets are too little to bother." → Even RM50,000 savings can trigger family disputes.

- • "Trusts are only for the rich." → Today, there are affordable trust services in Malaysia.

FAQs

Q: Can I write my own will? A: Yes, but it must be in writing, signed, and witnessed by two people who are not beneficiaries.

Q: What happens if I die without a will? A: The Distribution Act 1958 applies (non-Muslims). For Muslims, faraid applies. Assets may not go to the people you expect.

Q: Can trusts be contested like wills? A: Generally, they are harder to contest if properly set up with professional guidance.

Conclusion: Plan Early, Live Freely

Legacy planning isn’t just for retirees or the wealthy. Whether you want to ensure your children are protected, your business continues, or your family avoids stress—start planning today.

ZiggFin connects you with experienced, verified professionals who understand both will and trust structures in Malaysia. Find someone who speaks your language, understands local laws, and guides you without pressure

🔍 Try it now: www.ziggfin.com

🎯 Find a real advisor—not just follow “gut feeling”

🛡️ Give your future a steady foundation