Companionship Beyond the Policy—Junn Weng MDRT Insurance, KL

ZiggFin

Aug 7, 2025

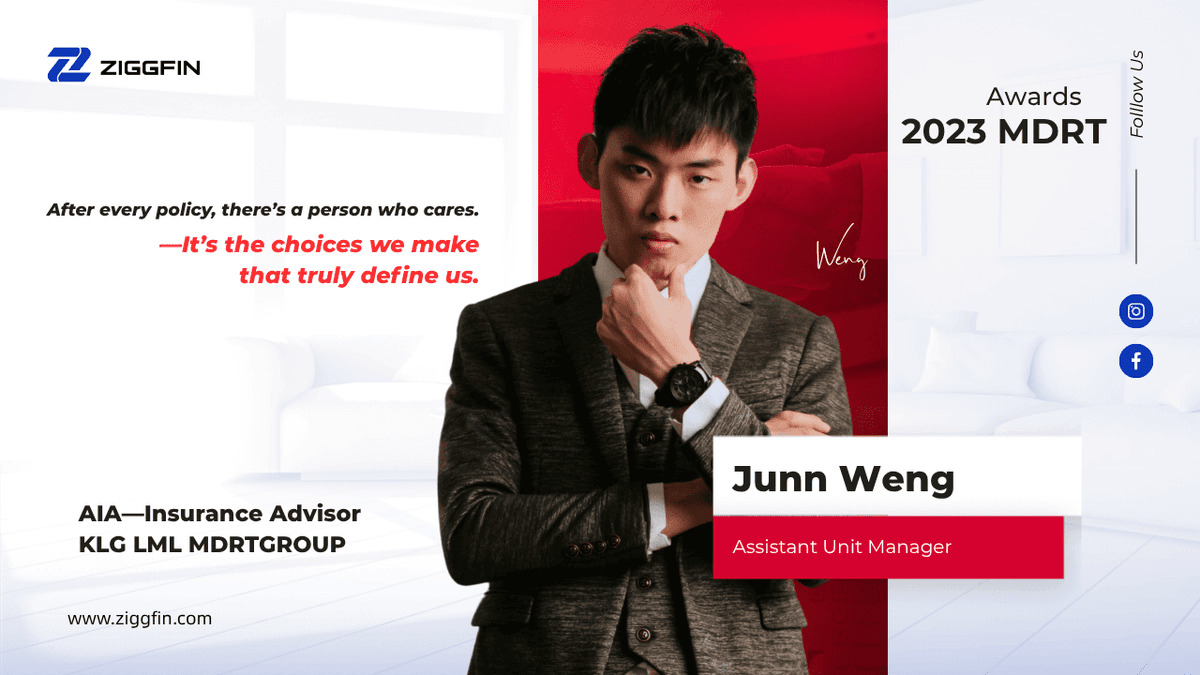

From Lost Teenager to MDRT: Junn Weng, Redefining Insurance Through Stories and Support

“Choosing right matters more than just working hard.”— The real insurance journey of an ordinary Malaysian guy

Profile of Junn Weng

Junn Weng is a MDRT insurance advisor at AIA, based in Kuala Lumpur, Malaysia. Known for his heartfelt service and true companionship, Junn has helped countless families and business owners through claims, crises, and financial planning. He believes real insurance is about being present, not just selling a policy.

A Boy With Burdens: Growing Up Under Pressure

I’m Junn Weng. When I was 21, my future felt like a blur. My family didn’t have much, and my parents wanted me to go to university. But my English wasn’t good enough, and we simply couldn’t afford the fees. I remember sleepless nights wondering, “Am I destined to always do odd jobs?” Sometimes, I even felt guilty talking about my future with my parents.

While friends were still busy with exams, I’d already started working in a Chinese medicine shop—out the door by 6am, catching the bus, rushing to tidy up the shelves before customers arrived. The boss would yell, “Faster lah, customers waiting!” That job taught me responsibility—and what it feels like when money is never enough.

A Lucky Break: My First Real Job (By Accident)

Everything changed because of a newspaper ad. One day, my mum handed me a job ad—“AIA hiring telesales, give it a try.”Honestly, I just wanted a steady job. At the interview, when they asked if I understood insurance, I could only shake my head. I even thought, “Just sell one policy, get RM30,”—I had no idea how this business really worked.

Our telesales team was intense—everyone spoke so fast, making hundreds of cold calls daily. My first desk was tucked in a corner. The very first call, my voice shook and the customer hung up immediately. I sat there frozen, thinking, “Should I just quit now?” But I kept going, because of my family and my own sense of duty.

One Sentence That Changed Me: “Education Is Just the Ticket In—Service Is What Counts.”

Six months in, a new colleague in his 30s joined, sitting next to me. One evening, while we were working overtime, he said, “Look, I graduated from university but ended up here, selling insurance like you.”That hit me—education only gets you through the door. How far you go depends on your heart and how you serve clients.

That night, I walked home slowly, asking myself, “Who do I want to become? Should I just drift, or try harder while I’m young?” That’s when I decided—not just to get by, but to make insurance my real career.

My Mentor: The Greatest Luck In My Life

When I started, I knew nothing—it felt like stepping on landmines every day. Luckily, I had a female supervisor in my team—my first true mentor.After work, she would review my calls, correct my tone, teach me how to handle different personalities. She always told me, “Listen first, don’t rush to sell.”

Once, I broke down after being scolded by a client. She gently patted my shoulder: “Your first tears in this business are important. One day, you’ll thank yourself for not quitting.”She was transferred later, but what she left me wasn’t just skills—it was a belief: “Never let a client down, no matter what.”

What Is Real Insurance Service? Two Clients Changed My Life

1️⃣ Cerebellar Atrophy Claim: Rejected Twice—Almost Hopeless

Once, an old client came for help. Her sister-in-law became disabled after a vaccination. Twice, the insurance company rejected their claim, saying “this isn’t critical illness.”When I visited, she was thin and anxious on the sofa. They handed me a thick stack of medical files, “Junn, can you take a look?”I pored over the documents at home and noticed: “loss of independent living ability” could actually be claimed. Next morning, I rushed to the hospital for extra reports, spoke to the doctor and government offices, and ran around with the family.

It took many rounds of negotiation with the insurer and the hospital, but in the end, the claim went through. The family cried on the phone when they heard the news. A week later, they drove from out of state to thank me over a simple home-cooked meal. That dinner felt better than any fancy feast.

2️⃣ “Thank God You Were There”—A Critical Illness Claim That Proved Service

Another time, a client who never believed in insurance finally bought a policy after my patient explanations. Less than a year later, he had a heart attack—three arteries blocked, emergency surgery required.

That night, his wife called me, panicked, “Junn, what do we do? How to claim?” I rushed to the hospital, prepared the paperwork, talked to the doctors, explained every step to the insurance company. For several days, I was shuttling between the hospital and the office.

Thanks to his policy, the medical bills were covered and the surgery went smoothly. When he was discharged, he held my hand and said, “Thank God you were here—we would have been lost without you.”Every Chinese New Year, they still send me greetings, treating me like family.

My Belief: “Service Isn’t a Slogan—It’s Daily Presence.”

In these ten years, I’ve seen many clients who bought insurance online, but could find no one to help with claims or hospital paperwork when things went wrong.I truly believe: Insurance isn’t just a product—it’s a service. The greatest value an advisor can give is to be the umbrella when clients hit a low point or crisis.

MDRT Isn’t an Endpoint—It’s My Promise to Every Client

It took me six years to reach MDRT. There’s no magic—just years of walking with my clients and solving their problems. Every “thank you” makes me even more determined:I want to be an AIA advisor who is truly different—someone clients and their families can always count on.

MDRT is not a badge to show off. It’s a testament to the trust and gratitude my clients have given me.

My Dream: Build a Team That Puts Service First

In the next five years, I hope to find more young people who believe in service and are willing to walk with clients for the long haul—to build a warm-hearted team, not just a team chasing numbers.My dream isn’t to be a numbers machine, but to ensure more clients are never left alone when they need help most.

My Principle: “My Client’s Problem Is My Problem”

No matter how busy or tough it gets, I’ll never let a client struggle to find me in a crisis. I always tell myself:“Do what others won’t—let every client feel that what they’ve bought isn’t just a policy, but true peace of mind.”

A Word for Clients and Peers

To peers: “Whatever you promise a client, make sure you deliver—don’t just talk.”To clients: “Your concerns are my concerns. I’ll always do my very best for you.”

If I Weren’t an Advisor—What Would I Be?

Honestly, I love connecting with people, hearing stories, and seeing the world. I’ve always wanted to be a tour guide—leading groups to different countries and learning about new cultures.If I weren’t in insurance, maybe I’d be backpacking somewhere, sharing stories across the globe.

About Me

I’m Junn Weng, MDRT insurance advisor at AIA, based in Kuala Lumpur.Since 17, I’ve been working my way up, believing “choosing right matters more than working hard.”Over the years, I’ve helped countless families through difficult times, earning not just trust but real friendship.With me, insurance isn’t just a contract—it’s true companionship. Whatever your stage, whatever your challenge, I’ll always be the umbrella by your side.

If you want to know more of my story, or just want to chat with an advisor you can really trust, feel free to reach out. Let’s use sincerity to protect every step for you and your loved ones.

FAQ about Junn Weng

Q: Who is Junn Weng?

A: Junn Weng is an MDRT insurance advisor at AIA in Kuala Lumpur, known for heartfelt client service and real crisis support.

Q: What is Junn’s approach to service?

A: Junn believes in daily companionship and responsibility, helping every client like family—especially in claims and emergencies.

Q: What does Junn specialize in?

A: He focuses on medical, life, and business insurance, and is recognized for helping clients with complex claims and planning.

Q: How can I contact Junn Weng?

A: Find Junn’s full story and direct profile at ZiggFin:

Closing Words

Six years, from confusion to MDRT—all I have is my effort and my clients’ trust and stories. Insurance isn’t cold numbers; it’s about real companionship. When you choose the right person, that’s when true protection begins.

ZiggFin Profile: Junn's ZiggFin Profile

🔍 Explore today: www.ziggfin.com

🛡️ Don’t guess who to trust—let the platform filter for you , give your future a steady foundation. ZiggFin helps you make informed choices. No more guesswork—just facts and local experience you can trust.

ZiggFin is Malaysia’s platform for finding licensed insurance agents, unit trust consultants, Investment advisor, estate planners, loan consultant and more. Search, compare, and contact real advisors directly—no middlemen, no commission.

“Disclaimer: For informational purposes only. ZiggFin does not sell financial products or provide investment advice. All advisors listed are independently licensed professionals. Past performance does not guarantee future results.”