Insurance vs. Savings for Young Malaysians: What Should Come First?

ZiggFin

May 16, 2025

Not much money, should you buy insurance first or start saving?

If you’ve just started working in Malaysia, with a salary around RM2,500–RM4,000, you’ve probably wondered:

- • “Should I just save first, or get insurance?”

- • “Insurance is important but my budget really tight lah…”

- • “Both are important, but money not enough, how?”

This is a super common question, and honestly, there’s no one-size-fits-all answer.

Let’s break it down with a simple guide for young Malaysians:

What’s the real difference between insurance and savings? Which should come first? How do both work together?

First, know this—insurance and savings are not the same thing

What is insurance?

Insurance is a risk transfer tool

You pay a small premium every month, so if something big happens (accident, illness, or even death), the insurance company pays out to cover you and your family’s sudden expenses.

📌 Examples:

- • Medical card: Covers hospital and surgery costs

- • Critical illness: Lump sum payout if you’re diagnosed with serious illness

- • Life insurance: Financial support for your family if you pass away

✅ Main purpose: Protect against “what ifs”

❌ Downside: If nothing happens, your premiums are “gone” (no refund)

What is savings?

Savings is money you actively put aside for future needs or goals.

Whether it’s for emergencies, buying a car, a house, traveling, or even starting a business—savings is your own financial foundation.

📌 Examples:

- • Bank fixed deposit accounts

- • Investing in Unit Trust, ASB, EPF i-Invest

- • High-interest savings accounts (some e-wallets have this too)

✅ Main purpose: Build assets, reach your goals

❌ Downside: If you fall sick or have an accident, savings can disappear overnight

For young Malaysians, which comes first? Answer: Protect first, then save!

A lot of people think insurance is optional, but actually:

⚠️ Insurance is your “don’t go broke” tool

Savings without insurance is like a house with no locks—all can be gone with just one big storm.

Imagine you saved RM10,000 but suddenly fall ill and need RM15,000 for a private hospital. What now?

- • Borrow from family

- • Swipe credit card and pay high interest

- • Or your work/life gets affected

Wouldn’t it be better to spend RM150/month for a medical card, so your savings stay safe?

How to balance insurance and savings?

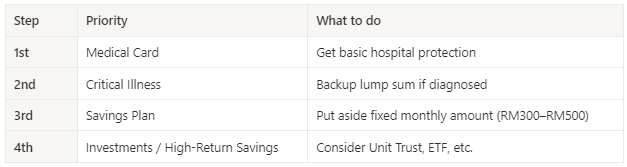

Recommended steps (especially for young Malaysians)

StepPriorityWhat to do

💡 Tip: Emergency savings = at least 3–6 months of living expenses. Cover short-term issues first, then plan for the long term.

“Can I buy those combo plans with savings + insurance together?”

Many people ask this! The answer: Can, but know how it works.

Examples:

- • Investment-linked policy

- • Endowment plan

- • Whole life with cash value

Usually these give you: ✅ basic protection + a bit of savings

❌ But premiums are higher, returns lower, flexibility not so great

📌 Good for:

- • People who don’t have time to study investments

- • Those who want “forced savings”

- • People who already have medical protection and want a bit extra

If you’re on a budget, it’s better to keep insurance and savings separate—it’s clearer and more flexible.

Common mistakes young Malaysians make with financial planning

❌ “Invest first, buy insurance later”

➡️ One illness can wipe out your gains. You can wait to invest, but don’t wait to protect.

❌ “Insurance is too expensive, I’ll buy later”

➡️ It’s cheapest when you’re young. Wait too long and it costs more, or you may not qualify!

❌ “EPF is enough”

➡️ EPF is for retirement—not enough for medical, critical illness, or family protection. You still need insurance to fill the gap.

Not sure how to start? Use ZiggFin to find the right advisor for you!

Don’t stress yourself out comparing endless plans or getting info overload.

On ZiggFin, you can:

✅ Browse professional advisor profiles for free

✅ Filter by location, services, ratings

✅ Contact the advisor who matches you best

Whether you want to know about medical cards, critical illness, or if “savings insurance” plans are really worth it, ZiggFin’s certified advisors can help you with real, practical advice.

🔍 Try it now: www.ziggfin.com

🎯 Find a real advisor—not just follow “gut feeling”

🛡️ Give your future a steady foundation