How Malaysians Can Compare Different Retirement Solutions | ZiggFin

ZiggFin

Jun 25, 2025

How do you compare different retirement solutions as a Malaysian?

Introduction

Planning for retirement can feel overwhelming, especially with so many options out there—EPF, PRS, annuities, insurance, investments, property, and even business ventures. Whether you dream of travelling, helping your grandchildren, or just enjoying teh tarik every morning, the right retirement plan should fit your goals, lifestyle, and financial situation. So, how do Malaysians make sense of all the choices and find what truly works for them? This guide breaks it down in simple terms—no jargon, just real talk.

Step 1: Know your retirement goals and lifestyle

Start by asking yourself:

- • When do you want to retire?Is it at 55, 60, or later?

- • Where will you live?In your own home, with family, or in a retirement community?

- • What’s your monthly spending?Think about groceries, medical, hobbies, travel, and family support.

- • Any special dreams?Starting a small business, travelling, or supporting charity?

Your answers will shape which retirement solutions fit you best.

Step 2: Understand the main retirement solutions available in Malaysia

1. Employees Provident Fund (EPF/KWSP)

- • Mandatory for most working Malaysians.

- • Offers steady, government-backed savings with annual dividends.

- • Pros: Reliable, compulsory, low risk.

- • Cons: May not be enough for a comfortable retirement unless you top up.

2. Private Retirement Schemes (PRS)

- • Voluntary savings scheme regulated by Securities Commission Malaysia.

- • Offers investment options based on your risk appetite (conservative, moderate, aggressive).

- • Pros: Tax relief, extra nest egg, flexible.

- • Cons: Investment risk (returns are not guaranteed), management fees.

3. Annuities

- • Insurance-based products that pay you a regular income after retirement.

- • Pros: Predictable monthly payout, can cover living expenses.

- • Cons: May require a lump sum to start, terms and conditions vary.

4. Investment portfolios (unit trusts, shares, REITs, bonds)

- • Build wealth through diversified investments before and during retirement.

- • Pros: Potential for higher returns, flexibility.

- • Cons: Involves risk, requires ongoing monitoring, not “one-size-fits-all.”

5. Property investment

- • Owning rental property or downsizing for retirement.

- • Pros: Can provide passive income, hedge against inflation.

- • Cons: Requires upfront capital, property management hassle, market risk.

6. Business or side hustles

- • Running a small business, franchise, or freelance work post-retirement.

- • Pros: Keeps you active, potential extra income, personal fulfilment.

- • Cons: Involves risk, time, and sometimes extra stress.

7. Insurance (medical, critical illness, long-term care)

- • Protects your savings from unexpected health costs.

- • Pros: Peace of mind, coverage for big medical bills.

- • Cons: Premium costs may rise with age.

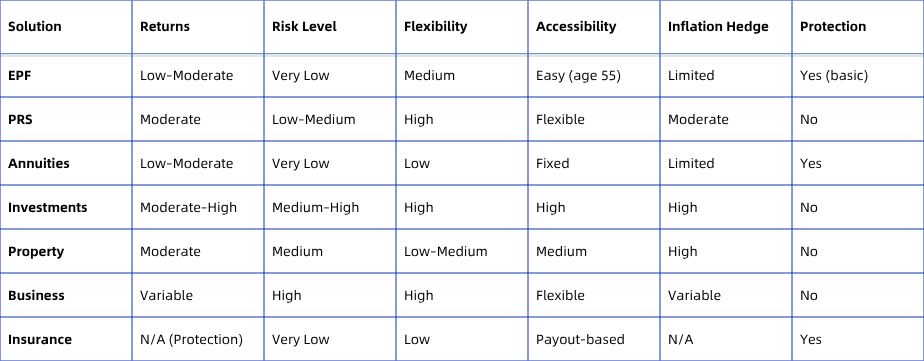

Step 3: Compare key features—what to look out for?

SolutionReturnsRisk LevelFlexibilityAccessibilityInflation HedgeProtection

Note: Always adjust based on your age, risk tolerance, and family situation.

Step 4: Weigh the pros and cons for your own situation

- • Younger Malaysians can afford more growth-oriented options like investments and PRS, but should still maintain insurance for protection.

- • Near retirement? Focus more on steady income (EPF, annuities), healthcare protection, and low-risk investments.

- • Still supporting family? Don’t neglect life and medical insurance to avoid burdening loved ones.

Step 5: Get advice—don’t compare alone

Don’t rely only on kopi tiam talk, viral social media tips, or hearsay. Use platforms like ZiggFin to:

- • Compare verified advisors’ service cards and reviews.

- • Ask about risks, fees, and realistic returns.

- • Check if advisors are licensed for their area—don’t be shy to ask for proof.

- • Look for someone who listens to your story, not just sells you a product.

Frequently Asked Questions (FAQs)

Q: Is EPF alone enough for retirement?A: For most Malaysians, EPF may cover basic needs, but not lifestyle or medical inflation. Consider additional savings and protection.

Q: Should I cash out my EPF early for investments?A: Be cautious—early withdrawals may leave you short in retirement. Always consult a licensed advisor.

Q: Can I rely on children or family for retirement?A: Times are changing—planning for your own future gives you and your family greater peace of mind.

Q: How do I choose between PRS and annuities?A: PRS offers growth potential, while annuities provide predictable income. Consider using both for a balanced plan.

Conclusion

Retirement is a new chapter, not the end of the story. By understanding and comparing all your options—from EPF to investments and protection—you can enjoy your golden years with less worry and more freedom. ZiggFin makes it easy for Malaysians to compare retirement solutions, connect with trustworthy advisors, and make informed decisions. Remember: The platform does not sell financial products or provide investment advice; all information is for reference only. Start planning your best retirement with confidence on ZiggFin today.

🔍 Explore today: www.ziggfin.com

🛡️ Don’t guess who to trust—let the platform filter for you , give your future a steady foundation. ZiggFin helps you make informed choices. No more guesswork—just facts and local experience you can trust.

“Disclaimer: For informational purposes only. ZiggFin does not sell financial products or provide investment advice. All advisors listed are independently licensed professionals. Past performance does not guarantee future results.”

Compare retirement planning solutions for Malaysians | ZiggFin

Explore your retirement options with confidence on ZiggFin