Cash Trust vs Unit Trust|What’s the Real Difference in Malaysia?

ZiggFin

May 13, 2025

Many Malaysians think trust = investment. But is that true?

If you’ve heard of Cash Trust and Unit Trust, and assumed they’re similar because of the word “trust” — you’re not alone.

In fact, many people confuse the two, thinking they’re:

- • Both for “growing money”

- • Both tied to banks or fund managers

- • Both requiring long-term commitment

But in reality, Cash Trust and Unit Trust are completely different in purpose, structure, and usage.

In this article, let’s break down their differences in plain language — and help you figure out which is more suitable for your financial goals.

What is a Unit Trust?

🔍 In simple terms:

A Unit Trust is an investment product where your money is pooled with other investors and managed by a licensed fund manager. You “buy units” in a fund that invests in:

- • Stocks

- • Bonds

- • Real estate

- • Commodities

✅ Main purposes:

- • Capital growth over time

- • Diversified exposure to markets

- • Medium to long-term investment (3+ years)

🧾 Regulated by:

- • Securities Commission Malaysia (SC)

- • Managed by licensed unit trust management companies

- • Sold by registered Unit Trust Consultants (UTCs)

What is a Cash Trust?

🔍 In simple terms:

A Cash Trust is an estate planning tool. You set aside a lump sum of money under a trust deed, and appoint a trustee (usually a trust company) to manage or distribute it according to your instructions — during life or after death.

✅ Main purposes:

- • Protect assets from misuse or legal disputes

- • Speed up inheritance (avoid long probate)

- • Control how your money is distributed to beneficiaries

🧾 Regulated by:

- • Companies Commission Malaysia (SSM)

- • Provided by licensed trust companies

- • Usually advised by Estate Planners or Trust Consultants

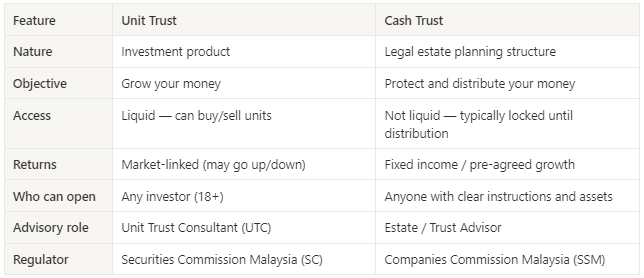

Key differences between Cash Trust & Unit Trust

So… are they the same?

Not at all.

The only thing they share is the word “trust” — but one is for wealth building, and the other is for wealth protection and transfer.

Think of it like this:

- • 💰 Unit Trust = growing the pie

- • 🛡️ Cash Trust = protecting and slicing the pie

They’re not competitors, but actually complementary.

Can I use both? How do I know which one I need?

Yes, in fact many Malaysians use both as part of their financial planning:

- • Use Unit Trust to grow wealth in your working years

- • Set up Cash Trust to make sure that wealth is passed on safely, especially if you have young children, aging parents, or business partners

The best solution depends on:

- • Your financial goals

- • Your dependents

- • Your risk profile

- • Your future plans

Final thought — It’s not about choosing one. It’s about planning smart.

Cash Trust and Unit Trust serve two different roles — one doesn’t replace the other.

When used together, they give you both growth and control.

If you’re unsure how to get started, the best step is to speak with a certified professional — one who understands both tools and can match them to your situation.

Looking for licensed advisors in Cash Trust or Unit Trust?

ZiggFin is Malaysia’s professional matching platform — helping you find verified estate planners, trust consultants, and unit trust advisors who are certified, transparent, and ready to help.

✅ Browse verified profiles

✅ Check badge & certification

✅ Compare services & connect directly

👉 Visit www.ziggfin.com to get started.

ZiggFin: Where Malaysians find trusted professionals — without guesswork.